Alabingo Finance Report

UBA Plc rode on the back of better earnings and significant reduction in its impairment charges on losses to put an impressive performance in the first quarter of 2018.

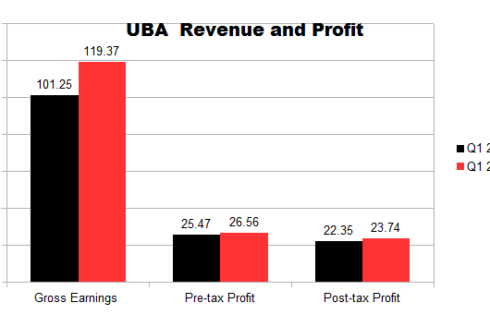

UBA improved its gross earnings 18 per cent to N119.37 billion in Q1 2018 underpinned on 79 per cent rise in cash and bank balances, which helped pushed interest income up 18 per cent to N90.33 billion. And 859 per cent increase in other operating income and fee and commission income, which was up 15 per cent, lifted non-interest earnings 14 per cent to N24 billion, in spite of -13 per cent drop in net trading and foreign exchange due to improved dollar liquidity in the Nigerian economy.

The lender was able to prune down its impairment charges on loan loss by 53 per cent to N1.45 billion instead of N3.1 billion in Q1 2017, due to significant drop in specific and portfolio impairment charges.

UBA income expenses almost doubled, rising 46 per cent to N36.78 billion as a result of cost deposits from customers and borrowings, which climbed 55 per cent and 87 per cent respectively in the first three months of this year. Credit-related fees and commissions cost which was up 48 per cent and money spent to rake in trade transactions income, which increased 46 per cent also caused fee and commission expenses to rise 21 per cent to N20.03 billion.

More so, UBA’s post-tax profit only rose 6 per cent to N23.74 billion as at this March this year, compared to 32 per cent profit-after-tax growth it had in the first three months of 2017.

The lower interest earnings from fixed income securities, bridle risk appetite as well as increasing operating expenses decelerated the growth of the commercial lenders’ revenues in Q1 2018.

The bank’s interest expenses increased 146 per cent to N36.78 billion, due to higher cost of deposits from banks and customers. Fee and commission expenses and operating cost were also up 143 per cent and 113 per cent respectively as it spent 143 per cent more on e-banking related activities and security and cash handling expenses also shot up.

UBA also lowered its risk appetite in Q1 2018, reducing loans and advances to customers by -2 per cent to N1.61 trillion in contrast to N1.65 trillion it gave out in Q1 2017. However, deposits from customers swelled 4 per cent to N2.85 trillion. And the bank total assets grew 6 per cent, while its total liabilities also expanded at the same rate during this period.

Meanwhile, there is believe that commercial lenders would experience accelerated growth as the year progresses due to anticipated improvement in the country’s economy as the government is bound to investment more in infrastructures in 2018.