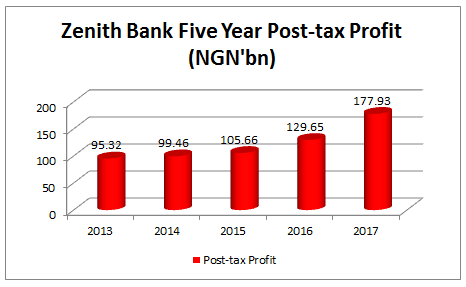

Alabingo Finance Report || Despite the economic hiccups in the country, Zenith Bank put up an impressive financial performance in 2017, growing its post-tax profit by 37 per cent to N177.93 billion. Consequently, the bank’s investors would be smiling to the bank with N2.70 dividend per share, 34 per cent higher than the N2.02 they got in 2016.

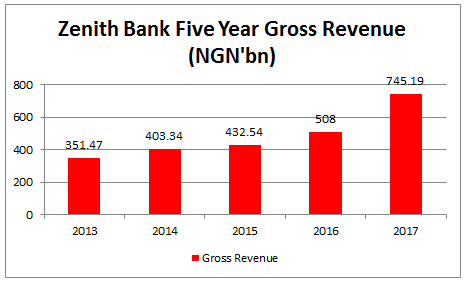

A review of the recently released 2017 financial statement of the commercial lender showed that its gross earnings was up 47 per cent to N745.19 billion on the back of 456 per cent rise in securities trading gains to N157.97 billion compared to N28.4 billion in 2016 with treasury bills trading climbing 928 per cent to N88.9 billion and derivative income increasing 242 per cent to N68.71 billion during period from N20.08 billion in 2016.

Zenith Bank grew its gross earnings 47 per cent to N745.19 billion as interest and similar income rose 23 per cent, while other operating income tumbled -16 per cent weakened by -51 per cent drop in foreign currency revaluation gain, due to the stability in the country’s forex market in the better part of 2017.

Significant improvement in the bank’s auction fees income by 145 per cent to N1.89 billion (Q4 2016: N772 million) and 86 per cent rise in commission from turnover to N1.74 billion bolstered its fee and commission which climbed 32 per cent to N90.14 billion compared to N68.44 in the corresponding period in the previous year.

Zenith Bank’s improved revenue came at a higher cost as there was a significant rise interest and similar expenses, which rose 50 per cent to N216.64 billion from N144.38 billion in 2016. Personnel cost was up 9 per cent to N64.46 billion, while operating expenses surged 43 per cent to N148.35 billion during the period under review.

And despite -8 per cent cut in the bank’s loans and advances to N2.1 trillion, its impairment provision went up by a whopping 204 per cent to N98.23 billion in Q4 2017 against N32.35 billion in the preceding year. The 16 months recession which Nigeria experienced between 2016 and 2017 has adversely impacted the non-performing loans (NPL) in the Nigerian banking industry with the sector’s average NPL ratio climbing to over 17 per cent in Q3 2017.

Meanwhile, customers’ deposits swelled 15 per cent to N3.44 trillion with savings and term deposits increasing 7 per cent and 3 per cent respectively and domiciliary deposit improved 10 per cent in 2017.

Treasury bills which soared 68 per cent helped increased Zenith Bank total assets 18 per cent to N5.6 trillion last year from N4.74 trillion in 2016. The bank has the largest asset in the country’s banking industry.

Increased dues to African Finance Corporation and ABSA Bank, which pushed the bank’s debt up by 35 per cent to N356.5 billion (Q4 2016: N263.11 billion) caused its total liabilities to rise 18 per cent to N4.77 trillion in 2017.

There was a 37 per cent upswing in Zenith Bank’s earnings per share to N5.66 from N4.12 in Q4 2016 and its P/E ratio stood at 5.10.

The lender’s stock shed -3.85 per cent to N28.75 on Thursday, despite the banking sector moving up 0.07 per cent. It has posted 105.30 per cent year-on-year return.