Alabingo Finance Report| Despite the slow economic growth in the country, United Bank for Africa pulled off a better-than-expected performance in the 2018 financial year.

It grew gross earnings by 7.0 per cent to N494.0 billion last year, compared to N461.6 billion recorded in the corresponding period of 2017, buoyed 45.54 per cent in Interest income on amortised cost and FVOCI securities, 34.16 per cent rise in investment securities and trade transaction income that was up 45.47 per cent.

Consequently, the bank’s Profit Before Tax was up 2.4 per cent to N106.8 billion, instead of N104.2 billion in the previous year, the Profit After Tax grew 1.4 per cent to N78.6 billion.

The N0.85 total dividend UBA is paying to its shareholders for the 2018 financial year reflects its impressive performance, said David Adorin, Managing Director, HighCap Securities.

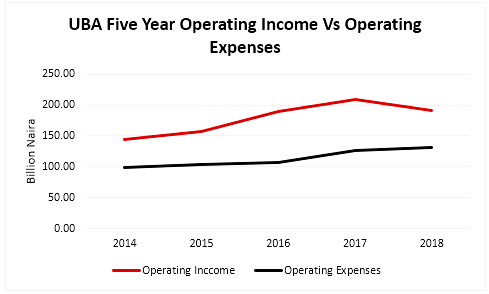

And due to lower foreign exchange trading income, Operating Expenses grew by 4.1 per cent to N197.3 billion, compared to N189.7 billion in 2017.

The lender’s modest appetite for risk in 2018 and the impact of IFRS 9 implementation made its net loans to increase marginally by 3.9 per cent to N1.72 trillion, while Customer Deposits was by 22.5 percent to N3.3 trillion, compared to N2.7 trillion recorded in the corresponding period of 2017, reflecting increased customer confidence and enhanced service channels.

More so, UBA total assets also grew significantly by 19.7 per cent to N4.9 trillion in 2018, from N4.1 trillion 9 in the prior year, on the back of a massive 322.8 per cent leap in derivative assets during this period.

Shareholders’ Funds decreased marginally by 4.8 percent to N502.6 billion, reflecting the impact of International Financial Reporting Standards 9 (IFRS 9) implementation.

The year 2018 was important for the Group, as it gained further market share in many countries of operation, said Kennedy Uzoka, Group Managing Director, UBA.

He noted that the pan-African lender made some strategic achievements last year, which included the start of wholesale banking operations in London as it seeks to leverage the Group’s unique network across Africa, and it opened its 20th African operation.

“Defying the relatively weak economic growth in Africa, earnings were positive, and we grew our balance sheet by 20 percent, driven by the 23 percent growth in our deposit funding. In a period of economic uncertainty, we have focused on retail deposit mobilization, with exciting results. We recorded a 48 percent year-on-year growth in retail deposits and improved our CASA ratio to 77 percent, optimizing our funding mix, which will enhance our net interest margin (NIM), over the medium term,” he explained.

The CEO believes UBA has a better prospect in the years ahead and shareholders would enjoy even greater dividends, as the Group is well positioned to take advantage of imminent fiscal reforms across many economies in Africa, a positive outlook which should stimulate new opportunities in infrastructure, manufacturing, agriculture and resource sectors.

He added, “Our operations in the United Kingdom now offer end-to-end trade, treasury, structured finance, wholesale deposit-taking and ancillary services. With this development, we are better positioned to fulfil our aspiration of deepening trade and capital flows between Europe and Africa. We are also pleased with the market acceptance of our new operation in Mali.

With great optimism, we look forward to a more rewarding 2019 for our shareholders, as we further sweat our resources and optimize productivity towards delivering superior returns,” he concluded.

For Ugo Nwaghodoh, the Group CFO, said that the improving mix of the Bank’s funding base and asset pricing, reinforce a positive outlook on Net Interest Margin (NIM) and broader balance sheet efficiency.

“Whilst considerable investment in people, digital transformation and channel enhancement masked cost efficiency gains within the year, with cost-to-income ratio at 64 percent, we are convinced that our diligent execution of new initiatives will ensure the reduction of Cost to Income Ratio (CIR) towards our medium-term target.

Our balance sheet is being positioned to take full advantage of market swings and our strong 25 percent capital adequacy ratio provides headroom for growth, even under a BASEL III scenario. As it stands, UBA has started the year on a good note and should sustain the momentum, as we work towards improving our Return on Average Equity (RoAE),” he asserted.

UBA’s stock has declined -20.51 per cent this year to N6.20 as at April 5 as the Nigerian bank suffered downturn that has seen its stock dipped -5.77 per cent in the last four months.

Leave a Reply