- Increases pretax profit by 34%

Alabingo Finance report|Fidelity Bank made significant trim in its non-performing loans ratio in the first three months of the year as profit before tax grew 34 per cent during this period.

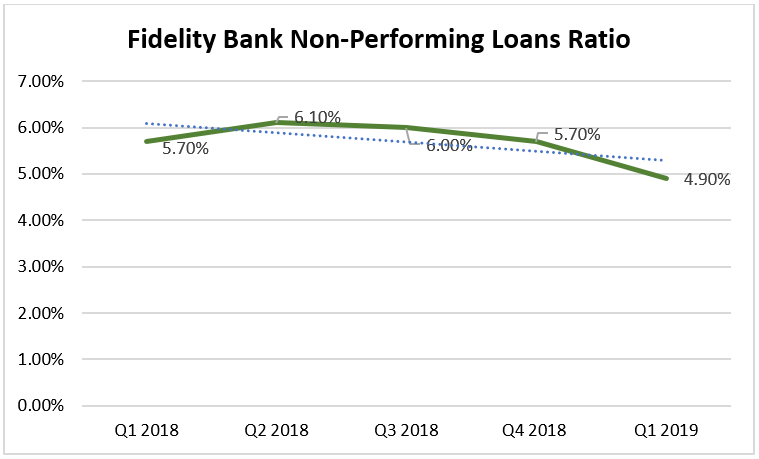

The lender cut down the size of its toxic loan to NPL ratio to 4.9 per cent in the first quarter of this year from 5.7 per cent at the end of 2018 financial year, underpinned on decline in absolute NPL numbers and increase in total loan book size, even though the bank had to make 47 per cent higher provision of N1.04 billion for credit losses during the period under review.

It succeeded in increasing pretax profit by 34.0 per cent YoY to N6.7 billion from N5.0 billion in Q1 2018, bolstered by N2.3 billion increase in foreign exchange income, interest income on liquid assets (N0.9 billion), and digital banking income (N0.6 billion).

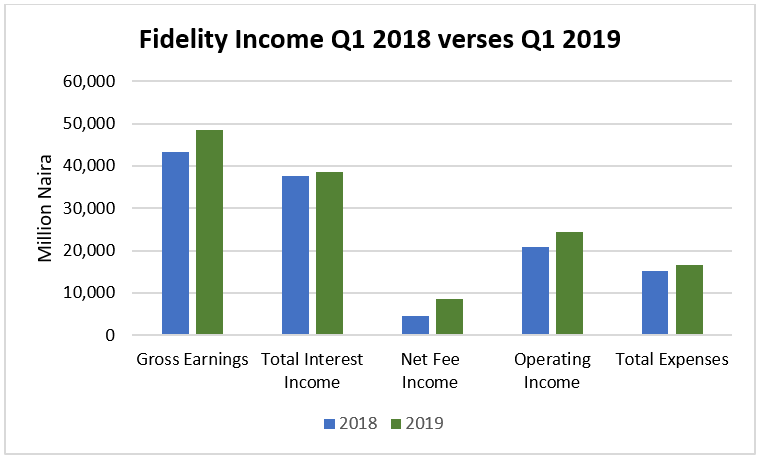

Meanwhile, the bank’s gross earnings was up 11.8 per cent to N48.4 billion against N43.3 billion in the similar period in the preceding year.

Total cost climbed up 10.4 per cent to N16.69 billion year-on-year from N15.12 billion in Q1 2019, propelled personnel cost and fees to regulators as well as depreciation, which accounted for over 60 per cent of the cost growth during this period.

But Fidelity Bank cost-to-income ratio declined to 68.4 per cent on account of our digital transformation initiatives.

The bank grew net loans and advances by 13.7 per cent in the first three months of this year to N966.3 billion, with 87.6% of total loan book in term loans and the growth was majorly on the back of increased credits extended to manufacturing, transport, agriculture and Oil & Gas Downstream.

Consequently, total assets expanded by 8.7 per cent to N1.87 trillion, buoyed by Balance with other Banks/Settlement Account was jumped 154 per cent during this period.

The lender was able to rake in more cheap funds as total deposits were up by 3.8 per cent to N1.02trillion from N979.4 billion at the end of 2018 as its total liabilities increased 28 per cent to N1.67 trillion.

“We expect the trend in savings deposits to continue in 2019FY as we deepen our digital drive and increase our retail products bouquet/offerings,” the bank told shareholders during its investors presentation last month.

The Chief Executive Officer of Fidelity Bank, Mr. Nnamdi Okonkwo, explained the double digit growth in earnings and profits further demonstrates a positive start for the new financial year.

“We remain focused on the execution of our medium-term strategic objectives and targets for the 2019 full year, while we look forward to sustaining the momentum and delivering another strong set of audited results for 2019,” he noted.

He asserted that digitalisation and the bank’s retail strategy have continued to positively impact on its fortunes with 43 per cent of customers now enrolled on the mobile/internet banking products, adding that more than 81 per cent of total transactions were done on digital platforms, resulting in 25 per cent of its fee-based income, now coming from digital banking.

Elaborating, he pointed out that the bank’s gross earnings rise had come on the back of growth in fund and fee-based income.

Fidelity Bank Cash Adequacy Ratio (CaR) dip marginally to 16.5 per cent in March 2019 from 16.7 per cent in 2018, although it was still above the Central Bank 15 per cent benchmark.

Also, the bank liquidity ratio slipped to 37.2 per cent, compared to 39.0 per cent achieved at the end of last 2018 financial year.

Leave a Reply