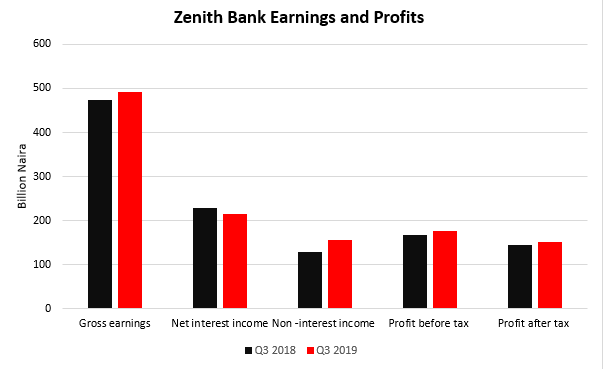

Alabingo Finance Report|In response to the challenging operating environment, Zenith Bank efficiently manage cost and significant grow non-interest revenue as it declared 4.54 per cent rise in Profit After Tax (PAT) to N150.72 per in its nine months financial statement.

The bank axed operating expenses by -6.59 per cent to N102.68 billion from N109.93 billion in the corresponding period in 2018 and interest costs were cut -2.93 per cent to N107.31 billion in Q3 2019. However, personnel expenses were higher by 10.40 per cent to N57.07 billion during this period.

Meanwhile, gross earnings increased by 3.51 per cent to N491.27 billion as at September 2019, propelled by fee and commission income and net trading income, which rose 19.09 per cent and 26.30 per cent respectively.

On the other hand, interest income declined -5.05 per cent to N321.94 billion during this period, dragged down loans and advances to customers, which declined -18.16 per cent year-on-year.

Profit Before Tax (PBT) grew by 5.31 per cent from N167.31 billion in Q3 2018 to N176.18 billion in Q3 2019.

David Adorin, Managing Director, Highcap Securities, believes commercial lenders have engaged inefficient cost management to cope with the tough business environment, and Zenith Bank did that adeptly in its nine months’ financial performance.

The commercial lender was able to give out 11.96 per cent more loans and advances to customers worth N2.04 trillion year-on-year as its total assets grew 6.42 per cent to N5.98 trillion.

With the Central Bank cutting down the volume of investment in government securities and increasing commercial lenders’ loan-to-deposit ratio to 65 per cent, banks in the country have increased the tempo for retail banking.

Expectedly, Zenith Bank was able to muster 20.65 per cent more deposits to the turn of N3.95 trillion in Q3 2019 as Zenith Bank’s total liabilities increased 5.51 per cent to N5.11 trillion during this period.

The bank made 27.37 per cent higher provisions for its credits which went bad, amounting to N18.26 billion instead of the N14.34 billion it provided for in Q3 2018.

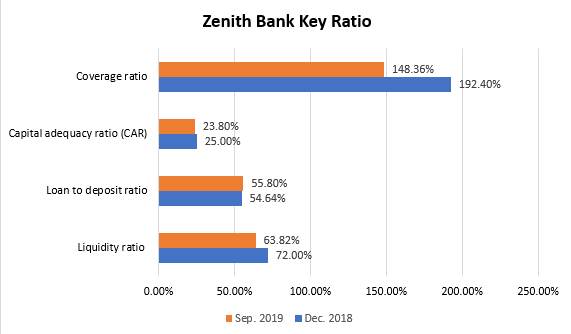

Consequently, non-performing loans NPL) ratio improved slightly to 4.95 per cent from 4.98 per cent in December 2018.

It was able to cut cost-to-income ratio down from 51.2 per cent in Q3 2018 to 50.1 per cent in Q3 2019, but grew Earnings Per Share (EPS) by 5 per cent from N4.58 in Q3 2018 to N4.80 in Q3 2019.

Leave a Reply