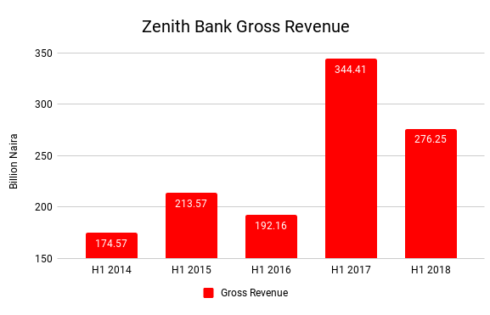

Alabingo Finance Report || Nigeria’s largest lender in terms of assets, Zenith Bank declared its highest half-year profit before tax in its 28 years of operations, in the first six months of 2018, underpinned on lower impairment charges on loan losses, despite decline in gross revenue.

Impairment charges on loans losses which crashed 77.07 per cent to N9.73 billion in the second quarter of 2018 from N42.4 billion in the corresponding period last year, was instrumental to the 16.46 per cent appreciation in bank’s pretax profit to N107.36 billion.

This is in spite of 15.31 per cent drop in its gross earnings to N322.20 billion during this period, triggered by 12.81 per cent decline in interest income to N228.67 billion and trading income, which went down significantly by 43.65 per cent due to derivative loss and 33.72 per cent cutback in other income occasioned by lower securities. However, fee and commission income ticked up 23.72 per cent to N46.71 billion.

Meanwhile, with the decline in Zenith Bank revenue, expenses also responded accordingly as interest cost slipped 33.72 per cent to N10.02 billion (H1 2017: N15.11billion), although operating cost was up marginally by 1.5 per cent and personnel expenses rose 12.16 per cent during this period.

“Cost-to-income Ratio decreased by 3.3 per cent YoY, from 56.7 per cent in H12017 to 54.9 per cent in H1 2018. We expect an improved ratio for the remaining of the year, as 6months AMCON charge was taken in H12018,” the bank explained in its investors’ presentation for H1 2018.

“Interest income declined because of a reduction in creation of risky assets – loan and advances

And as a result of lower interest regime – yield on treasury bills are coming down steadily,” elucidated Moses Ojo, Head, Business Development and Investment Research, PanAfrican Capital Plc.

He noted that exchange rate has stabilised to some extent, therefore, Nigerian lenders including Zenith Bank have not been reaping profits from foreign currency transactions like before.

In the first six months of the year, the lender’s customers deposits dipped 7.91 per cent to N3.17 trillion and loans and advances declined 10.82 per cent to N1.87 trillion as it tightened its risk appetite in order to curtail its rising non-performing loans (NPLs). Understandably, its loan-to-deposit ratio dropped 13 per cent to 53.5 per cent in H1 2018. And Zenith Bank total assets shrank 6.1 per cent to N5.26 trillion in the half of this year.

Well, Zenith Bank’s decision to up its risk management has not started paying off as its NPL ratio rose from 4.7 per cent in H1 2017 to 4.9 per cent. The bank was of the 10 banks that extended $1.2 billion loan to telecommunication firm, 9mobile, formerly called Etisalat Nigeria, which eventually went toxic. Nonetheless, it has significantly cut down its cost-of-risk by 75 per cent to 0.9 per cent.

However, despite the decline in deposits, Zenith Bank has surpassed its 2018 full year liquidity target of 60 per cent as its liquidity ratio appreciated 10 per cent to 77 per cent in the first six months of the year, when compared with 60.5 per cent in H1 2017. The regulatory liquidity threshold is 30 per cent.

The bank’s stock, which was traded at N22 on Wednesday, has appreciated 6.58 per cent in the last one year. And its price-earnings ratio (the zenith bank’s stock price to its earnings per share) stood at 3.75 per cent.

Although it aims for N182.7 billion for FY 2018, Ojo believes Zenith Bank would surpass its target at the end of the year. He projects a gross earnings of about N670 billion and a post-tax profit of around N185 billion.