Lagos State government will proceed with confirmed forged section of the New Tax Laws, as they move to deduct tax without court order from defaulters bank account and from account of anyone owing a tax defaulter.

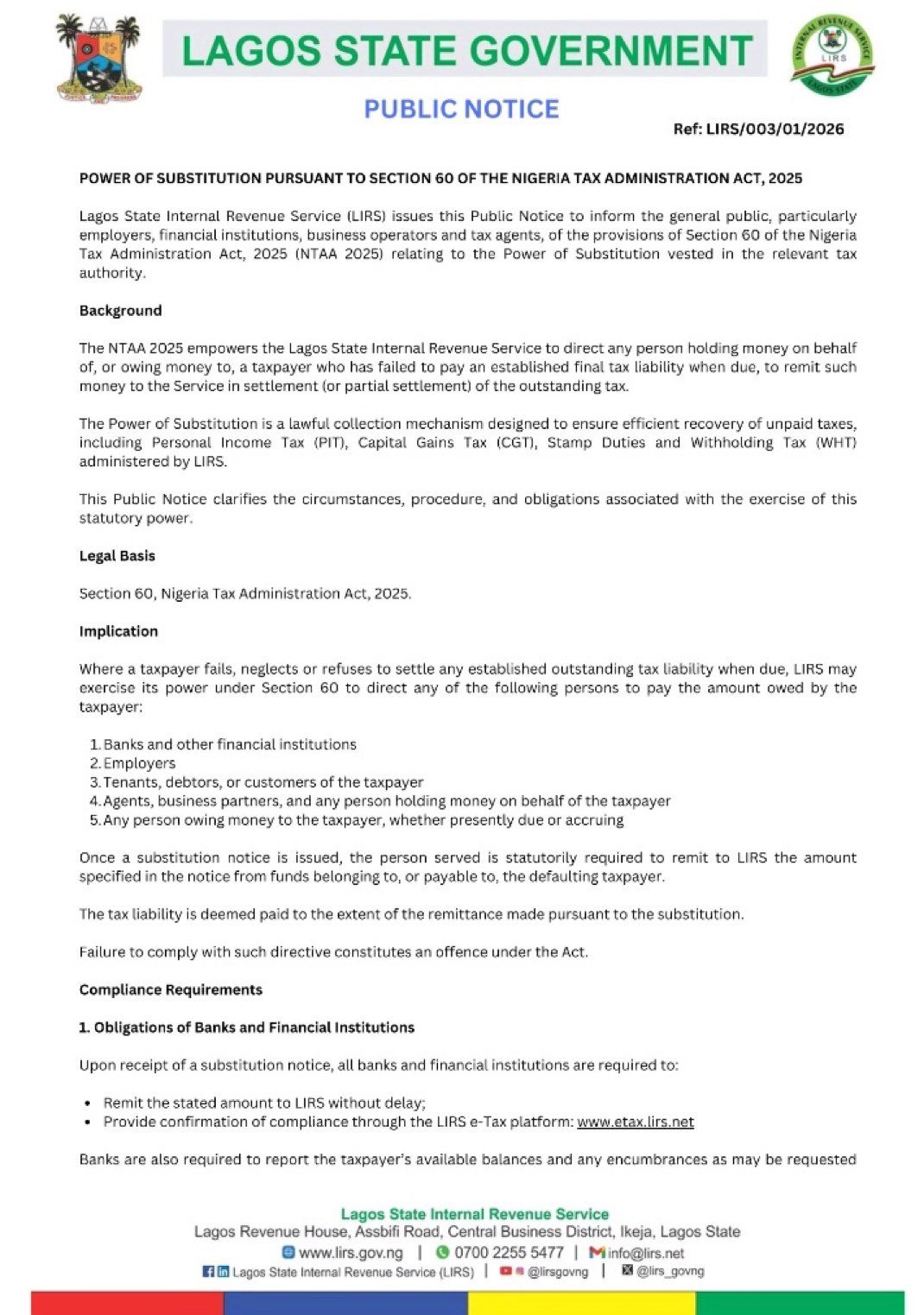

The state Inland Revenue Service issued a notice under the controversial Nigeria Tax Administration Act 2025, allowing it to direct banks, employers, and others to remit funds held for tax defaulters on taxes like personal income tax and withholding tax.

According to the agency, the power substitution kicks in after a final liability notice is ignored, requiring third parties to comply via the e-tax platform or face penalties.

Implications of the Power of Substitution under the new Tax Administration Act.

If LIRS says you owe tax and they’ve “established” it, they can:

• instruct your bank to pay them from your account

• instruct your employer to divert your salary

• instruct your tenants or customers to pay them instead of you

• instruct anyone who owes you money to settle your tax first

No court appearance.

No negotiation.

Just a notice.

Leave a Reply