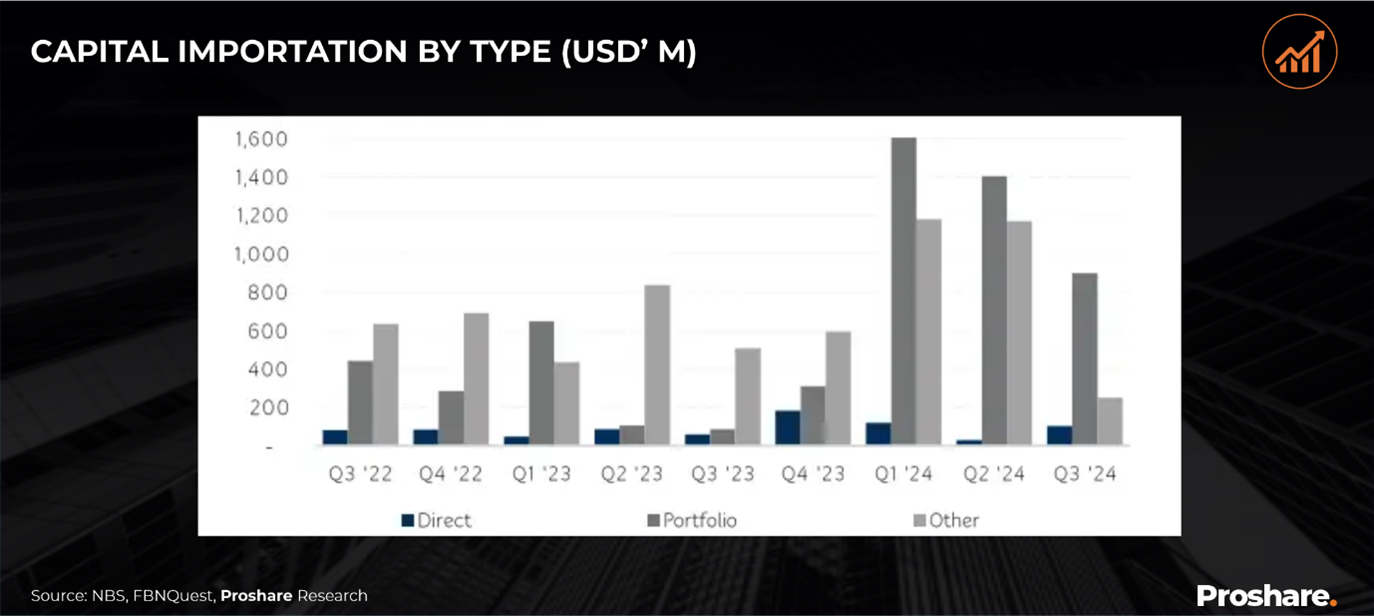

Capital Importation report from the National Bureau of Statistics (NBS) reveals that capital inflows into Nigeria declined by -52% quarter-on-quarter (QoQ) to approximately US$1.3bn in Q3 2024. However, on a year-on-year (YoY) basis, the value was 91% Y-o-Y higher. The sequential reduction in capital inflow was driven by double-digit decreases in inflows from Foreign Portfolio Investments (FPI) and other investments of the total capital inflow; portfolio investments comprised approximately 72%, while other investments and Foreign Direct Investments (FDI) accounted for about 20% and 8%, respectively.

–Despite its significant contribution to capital inflows, FPI inflow fell by -36% QoQ to US$899m, driven by reductions across all segments, with inflows into equity, bonds, and money market investments declining by between -43% and -61%

-Other investments, the next largest segment, declined by -79% QoQ to US$250m. The share of loans, which typically accounts for over 90% of the category’s inflow, plummeted to US$235m from almost US$1.2bn in Q2 2024.

-Conversely, foreign direct investment inflow increased to US$104m from US$30m in Q2 2024.

-Despite the increase, FDI remains significantly low, highlighting ongoing challenges in attracting substantial foreign investment.

-In terms of sector recipients, the banking sector, which typically dominates capital inflows, once again received the highest capital inflow of US$579.5m or 46% of all capital inflow.

-Financing and production/manufacturing were the next largest beneficiaries at US$295m (24%) and US$189m (15%), respectively.

-The United Kingdom was the leading source of capital inflow, with US$503m, or 40% of the total. South Africa and the USA followed with US$185m and US$163m, respectively.

-Regarding destination, only Lagos and Abuja (FCT) received meaningful capital inflows, with the former receiving US$650m while the latter getting US$600m (48%).

-Looking ahead, we anticipate substantial Q-o-Q growth in capital inflow in Q4 2024, driven by the FGN’s recent Eurobond issuance of US$2.2bn. Additionally, analysts expect ongoing investments in the oil and gas sector to contribute to FDI inflows in the coming quarters.

Source Proshare.com

Leave a Reply