Alabingo Finance Report || The United Bank for Africa (UBA) took advantage income from foreign exchange trading and term loans to corporate organizations to post a double digit profit-after-tax (PAT) in third quarter of 2017, despite operating expenses rises during this period.

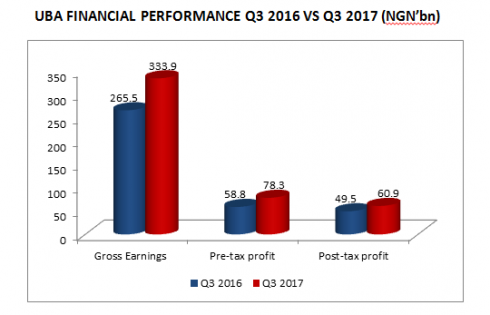

The pan-African bank gross revenue grew 25.75 per to N333.91 billion in Q3 2017 from N265.51 billion in the comparable period last year, driven largely by term loans to corporate organization which was up 48.71 per cent year-on-year to N113.20 billion and fixed income securities trading which leaped 81.58 per cent to N28.95 billion against N15.94 in Q3 2016.

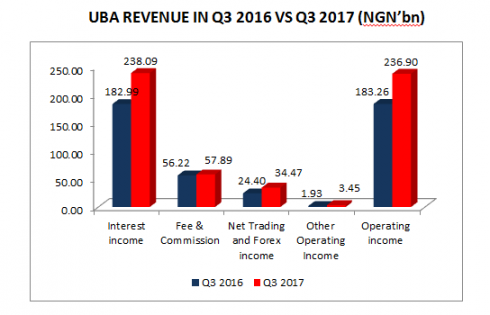

And the 30.11 per cent rise in interest income to N238.09 billion and 29.27 per cent increase during this period and 79.38 per cent surge in other operating income to N3.45 billion on the back of 119.96 per cent upswing in dividend income saw post-tax post improved 23.04 per cent to N60.92 billion (Q3 2017: N49.51 billion).

And while securities and forex trading income was up 41.30 per cent to N34.48 billion on the strength of 81.58 per cent upsurge in fixed income securities trading, fee and commission income rose marginally by 2.97 per cent to N57.89 billion in Q3 2017, weakened by -37.09 per cent slump in electronic banking income to N15.61 billion.

“The weakness on the non-interest income line also led to a 16 per cent q/q drop in pre-provision profits. Compare with our forecasts, PBT missed by 15 per cent. This was primarily due to a negative surprise in opex (+11 per cent more than what we are modelling,” FBN Quest research stated on the bank’s Q3 2017 performance.

It added, UBA’s 9M PBT of N78 billion tracks broadly in line with consensus PBT forecast of N103 billion for 2017. As such, we expect to see limited revisions to consensus earnings estimates and a broadly neutral reaction from the market.”

Cost of borrowings which swelled 233.22 per cent to N15.70 billion caused interest expenses to climb 20.98 per cent to N85.80 billion, while -81.16 per cent drop in e-banking related expenses to N 153 million dragged fee and commission cost down -1.21 per cent to N11.21 billion. In all, operating expenses went up 26.37 per cent to N145.7billion from N115.3 billion in Q3 2016.

The commercial lender’s impairment provision also rose 41.89 per cent to N12.91 billion.

UBA’s net loan grew 6 per cent year-to-date (YTD) to N1.60 trillion, while its total assets was up 7.6 per cent YTD to N3.77 trillion in Q3 2017 compared to N3.50 trillion in December 2016.

The bank’s customers’ deposits increased slight 1.4 per cent YTD to N2.52 trillion instead of N2.49 trillion at the end of last year and UBA total liabilities rose 6.76 per cent to N3.26 trillion during this period (FY 2016: N3.06 trillion). Meanwhile, cost-to-Income Ratio reduced to 61.5 per cent YoY reduction from 62.9 per cent in 2016Q3.

“The Group’s NPL ratio remains modest at 4.2 per cent with 119 per cent provision coverage (inclusive of prudential provision) and cost of risk eased 10bps to 1.1 per cent. Our success in low cost deposit mobilization is yielding the desired results, as we grew retail deposits by 14 per cent in the period, supporting our 8 per cent year-to-date balance sheet growth,” Kennedy Uzoka, Managing Director, UBA explained.

“To this end, we will progressively deliver superior return to our shareholders, as we extract new growth opportunities in our unique Pan-African franchise.”