…profit soars 112%

Alabingo Finance Report || In spite of the lull in the Nigerian economy, Zenith Bank Plc took advantage of the stability in foreign exchange market, revenue from fixed income securities to put up a better than anticipated performance in the first six months of 2017.

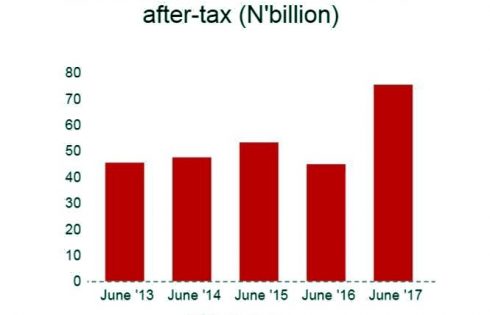

While other commercial lenders were struggling to grow their profits, the bank succeeded in improving its profit-after-tax (PAT) by a whopping 112.36 per cent to N75.32 billion compared to N35.47 billion in H1 2016.

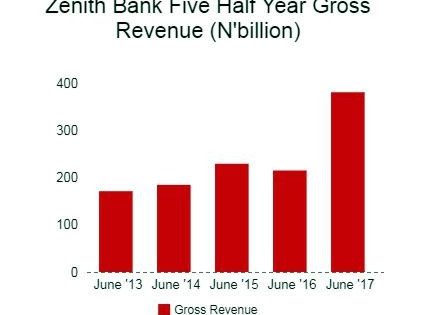

The bank’s gross revenue strengthened 77.10 per cent helped by N65.328 billion it earned from trading activities in H1 2017 against N864 million loss it recorded in the corresponding period last year and 44.57 per cent rise in interest and similar income to N262.26 billion during this period (H1 2016: N181.41 billion).

Mr Johnson Chukwu, Managing Director, Cowry Assets Management company Ltd said Zenith Bank half year performance beat investors’ expectation. “Shareholders should expect better returns at the end of the year if it maintains this trend,” he said.

Income from Forex trading served as a critical catalyst in the upsurge of Zenith Bank revenue moving from a N2.80 billion loss in H1 2016 to N46.42 billion income in the first half of this year.

The lender’s half year 2017 financial statement showed that it also made significant improvement in fixed income securities as earnings from treasury bills jumped massively 754.61 per cent to N18.83 billion (H1 2016: N12.20 billion), while it raked in N68 million from bonds during the period under review instead of N272 million loss it declared in H1 2016.

Zenith Bank grew fee and commission income 22.97 per cent to N37.75 billion, driven by 167.93 per cent increase in fee from electronic products to N5.38 billion and 113.89 per cent rise in foreign currency transaction fees and commission to N1.72 billion. The N8.40 loan recovery the bank made during this period propelled other operating income up 323.66 per cent to N15.11 billion. It also had 95.85 per cent surge from forex revaluation gains to N5.56 billion.

The bank’s stock closed on the last Monday of August at N22.78, which was -15.60 per cent lower than its year high of N26.99, which it achieved on July 28.

The success it made in clipping impairment provisions -14.39 per cent to N96.56 billion from N112.79 in H1 2016 also bolster the improved performance it had in H1 2017.

However, the commercial lender spent 126.71 per cent more to N 123.30 billion in earning its interest and similar income from this period hiked by 210.08 per cent increase in the interest it paid on term deposits.

Zenith Bank personnel expenses was up 4.67 per cent to N36.21 on the back of directors’ fee and sitting allowances, which climbed 278.46 to N492 million. Similarly, higher cost of printing and stationary, corporate promotions; fuel and maintenance etc caused other operating expenses to 52.58 per cent to N80.07 billion in H1 2017.

The bank’s total assets grew 3.96 per cent to N4.93 trillion as loans and advances dropped -4.46 per cent to N2.19 trillion in H1 2017. Despite its derivatives liabilities declining -74.21 per cent, totals liabilities moved northward 4.25 per cent to N4.21 trillion in June 2017.

Earnings per share appreciated to N2.12, which was 65.63 per cent higher than H1 2016 N1.28.