Mr Tunde Fowler, the chief executive of Federal Inland Revenue Service, FIRS has told the presidency that economic recession and low oil prices contributed to the discrepancies in the actual and targeted revenues of the government in the last four years.

The FIRS boss made the disclosure in an answer to the query issued him by the presidency.

According to Fowler’s response, the actual tax collection since the beginning of President Muhammadu Buhari’s administration is lower than the 2012-2014, but in general terms, the FIRS under him has performed better regarding specific non-oil tax types, such as VAT and CIT.

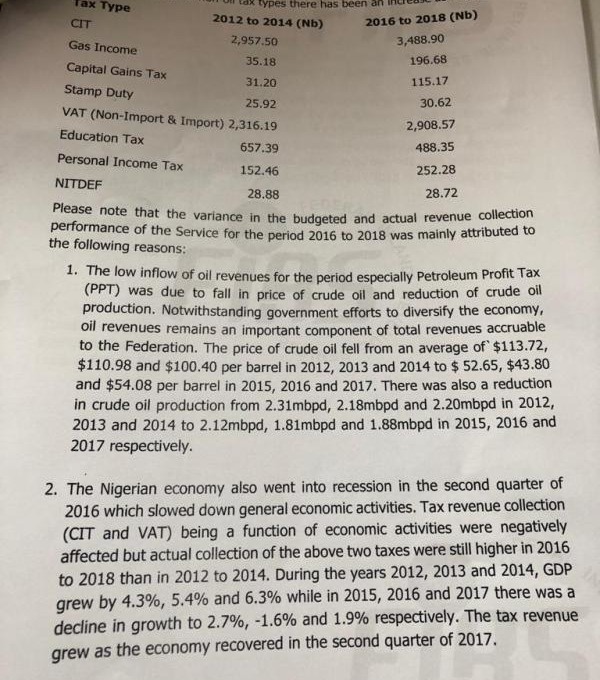

He explained, “The highlight of these collection figures was that during the period 2012 to 2014, out of the N14,527.85 trillion, oil revenue accounted for N8,321.64 trillion or 57.28%, while non-oil accounted for N6,206.22 or 42.72% and during the later period of 2016 to 2018, out of the N12,656.30 trillion oil revenue accounted for N5,145.8 trillion or 40.65% while non-oil accounted for N7,510.42 or 59.35%,” Mr Fowler explained, pointing at improvement in the non-oil collection.

According to him, FIRS has control of non-oil revenue collection, which “grew by N1,304.20 trillion or 21% between the period 2016 to 2018,” unlike oil revenue collection which is “subject to external forces to more external forces.”

“Notwithstanding government efforts to diversify the economy; oil revenues remain an important component of all revenues accruable to the Federation,” Mr Fowler said. “The crude oil price fell from an average of $113.72, $110.98 and 100.40 per barrel in 2012, 2013 and 2014 to $52.65, $43.80 and $54.08 in 2015, 2016 and 2017.

“There was also a reduction in crude oil production from 2.31 mbpd, 2.18 mbpd and 2.20 mbpd in 2012, 2013 and 2014 to 2.12 mbpd, 1.81 mbpd, and 1.88 mbpd in 2015, 2016 and 2017, respectively.”

“The Nigerian economy also went into recession in the second quarter of 2016 which slowed down the general economic activities,” he said. “Tax revenue collection (CIT and VAT) being a function of economic activities were negatively affected but actual collections of the above two taxes were still higher in 2016 to 2018 than in 2012 to 2014,” he said.

“During the years 2012, 2013 and 2014, GDP grew by 4.3%, 4.4% and 6.3%, while in 2015, 2016 and 2017, GDP grew by 2.7%, -1.6% and 1.9%, respectively. The tax revenue grew as the economy recovered in the second quarters of 2017.”

By our checks, between 2012 and 2014, CIT revenue was N2.9 trillion and N3.5 trillion between 2016 and 2018. Also, VAT between 2016 and 2018 was N2.9 trillion, higher than N2.3 that was gained between 2012 and 2014.

The “strategies and initiatives” adopted for the collection VAT under him was responsible for the increase over the 2012 to 2014 period, he said.

“In 2012, the VAT collected was N802 billion compared to N1.1 trillion in 2018,” he said. “This increase is attributable to various initiatives such as ICT innovations, continuous taxpayer education, taxpayer enlightenment, etc embarked upon by the Service”, he concluded.

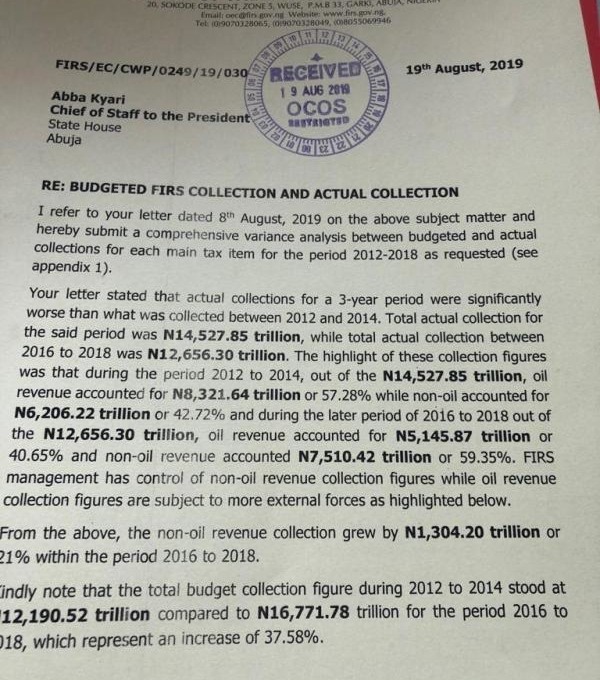

It will be recalled that the presidency had in a letter dated August 8, asked Fowler to account for discrepancies in the actual and expected revenue under his watch in the last four years.

The letter by Abba Kyari, chief of staff to the president, read, “Your attached letter (FIRS/EC/CWP/0249/19/027 dated 26 July 2019) on the above subject matter, refers.

“We observed significant variances between the budgeted collections and actual collections for the period 2015 to 2018. Accordingly, you are kindly invited to submit a comprehensive variance analysis explaining the reasons for the variances between budgeted and actual collections for each main tax item for each of the years 2015 to 2018.

“Furthermore, we observed that the actual collections for the period 2015 to 2017 were significantly worse than what was collected between 2012 and 2014. Accordingly, you are kindly to explain the reasons for the poor collections.

Leave a Reply